Explore Token Metrics: Empowering Informed Crypto Decisions

Navigating the volatile cryptocurrency market can be a daunting task, even for the most experienced investors. The need for data-driven solutions has become increasingly essential in making informed investment decisions.

We are witnessing a significant shift in how investors approach cryptocurrency decisions, with analytical tools playing a crucial role. Token Metrics is revolutionizing this space by providing a comprehensive platform that caters to both novice and experienced crypto investors.

By leveraging token metrics, investors can gain valuable insights into the crypto market, enabling them to make more informed decisions. In this article, we will explore the features, capabilities, and practical applications of Token Metrics.

Key Takeaways

- Understanding the importance of data-driven solutions in cryptocurrency investment decisions

- Exploring the comprehensive approach of Token Metrics

- Learning how Token Metrics caters to both novice and experienced crypto investors

- Gaining insights into the features and capabilities of Token Metrics

- Discovering the practical applications of Token Metrics in the crypto market

Understanding the Crypto Investment Landscape

As the crypto market continues to grow and mature, investors need reliable tools to make informed decisions. The cryptocurrency space is known for its rapid pace and unpredictability, making it challenging for investors to stay ahead of the curve.

In this context, understanding the crypto investment landscape is crucial. It involves navigating through a sea of information, distinguishing between noise and valuable insights, and making decisions based on comprehensive analysis.

The Challenges of Crypto Investment Decision-Making

Crypto investment decision-making is fraught with challenges. The market’s 24/7 nature means that key market moves can occur at any time, catching investors off guard. For instance, being engrossed in a discussion about memecoins might cause an investor to miss a token that could potentially 10X their portfolio.

The emotional aspect of market reactions can also cloud judgment, leading to impulsive decisions. Therefore, it’s essential to have a systematic approach to evaluating investment opportunities.

The Need for Data-Driven Analysis in Cryptocurrency Markets

To overcome these challenges, investors are turning to data-driven analysis. This approach provides objective insights that go beyond emotional market reactions. By leveraging metrics and research, investors can identify projects with long-term potential, reveal patterns not immediately obvious, and develop sustainable investment strategies.

Some key aspects of data-driven analysis include:

- Using fundamental analysis to identify projects with strong fundamentals.

- Applying technical metrics to uncover hidden patterns.

- Conducting research to inform investment decisions.

- Employing quantitative approaches to compare projects across different blockchain ecosystems.

By adopting a data-driven approach, investors can make more informed decisions in the cryptocurrency market.

Platforms like Token Metrics are filling the critical need for comprehensive data analysis in crypto markets, providing investors with the metrics and data required to navigate this complex landscape.

What is Token Metrics?

In the rapidly evolving world of cryptocurrency, Token Metrics stands out as a beacon for investors seeking clarity and insight. As we delve into the world of crypto investments, it becomes increasingly clear that having a reliable source of data is crucial for making informed decisions.

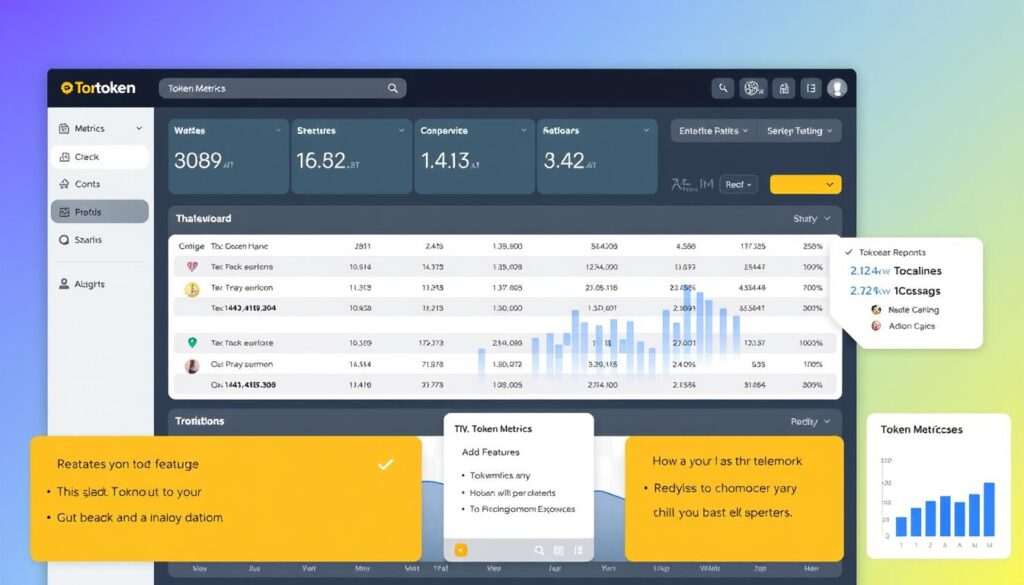

Overview of the Token Metrics Platform

Token Metrics is a comprehensive crypto analysis platform that transforms complex data into clear, actionable investment insights. By leveraging advanced data analytics and machine learning algorithms, Token Metrics provides a data-driven approach to cryptocurrency investment, enabling investors to discover promising projects before they reach mainstream attention.

The platform’s rating systems offer objective evaluations that cut through market hype and emotion, giving investors a clear understanding of a project’s potential. With Token Metrics, investors can compare different crypto assets across multiple dimensions, supporting both long-term investment strategies and shorter-term trading approaches.

How Token Metrics Empowers Crypto Investors

Token Metrics empowers crypto investors by providing them with the tools and insights needed to navigate the volatile cryptocurrency market. The platform’s data-driven insights help investors manage risk and make more informed decisions in various market conditions.

By utilizing Token Metrics, investors can gain a deeper understanding of the crypto market and identify opportunities that might otherwise go unnoticed. Whether you’re a seasoned investor or just starting out, Token Metrics offers the insights and analysis needed to succeed in the ever-changing world of cryptocurrency.

With its comprehensive approach to crypto analysis, Token and Metrics combined provide a powerful tool for investors. The platform’s ability to analyze vast amounts of data and provide actionable insights makes it an indispensable resource for anyone looking to make informed investment decisions in the crypto space.

The TM Investor Grade System

At the heart of Token Metrics lies the TM Investor Grade System, a sophisticated framework for evaluating cryptocurrency projects. This system is designed to provide investors with a comprehensive analysis, empowering them to make informed decisions in the complex crypto market.

Understanding the Three-Pillar Approach

The TM Investor Grade System is built on a three-pillar approach, comprising Fundamental Grade, Technology Grade, and Valuation Grade. This multi-faceted methodology ensures that investors receive a holistic view of a project’s strengths and weaknesses.

Fundamental Grade: Evaluating Project Strength

The Fundamental Grade assesses a project’s overall health by examining factors such as team experience, market demand, and community engagement. This grade provides insights into a project’s potential for long-term success.

Technology Grade: Assessing Code Quality and Security

The Technology Grade evaluates the technical aspects of a project, including code quality, security measures, and scalability. This assessment is crucial in determining a project’s ability to adapt and thrive in a rapidly evolving technological landscape.

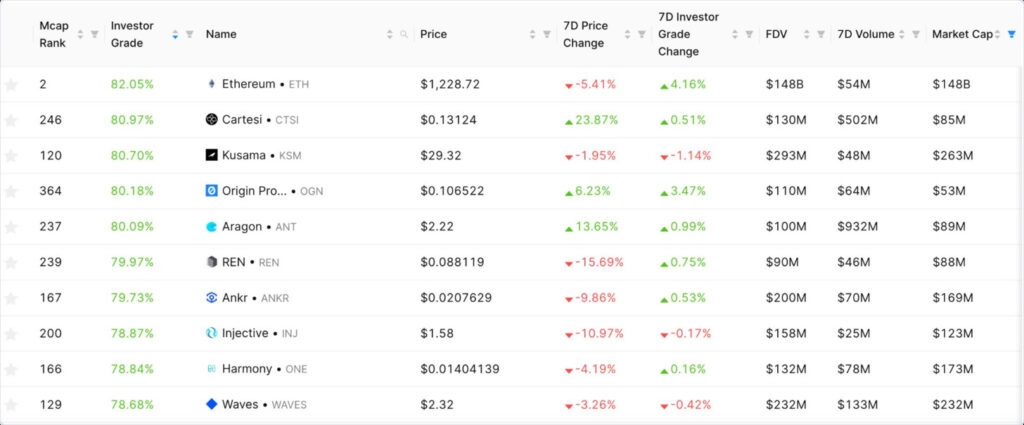

Valuation Grade: Comparing Project Worth

The Valuation Grade compares a project’s fully diluted value (FDV) with the average FDV of its relevant sectors. For instance, if a project’s FDV is lower than the average FDV of its sectors, it may indicate that the project is undervalued, presenting a potential investment opportunity. By combining these grades, we get the TM Investor Grade, which is a powerful tool for determining a project’s long-term strength.

The Valuation Grade helps investors identify undervalued or overvalued crypto assets relative to their peers. By comparing a project’s FDV to the average FDV of its sectors, investors can spot potential investment opportunities where market pricing doesn’t reflect project quality. This approach also helps investors avoid overpaying for hyped projects while identifying hidden gems with strong value propositions.

The TM Investor Grade System synthesizes all three aspects to determine a project’s long-term strength, providing investors with a comprehensive assessment that guides their investment decisions.

Advanced Features of Token Metrics

Token Metrics offers a range of advanced features designed to empower crypto investors with data-driven insights.

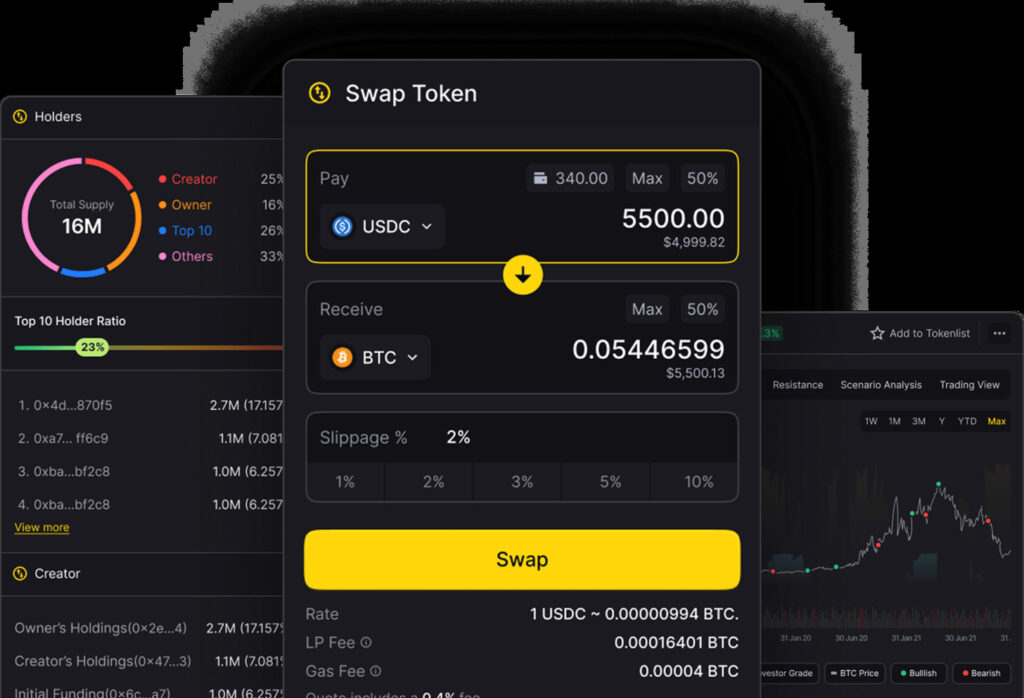

0xTMAI: AI-Powered Crypto Analysis

The 0xTMAI feature is a game-changer in crypto analysis, utilizing AI to provide investors with actionable insights. This AI-powered tool analyzes vast amounts of data to identify trends and patterns that may not be apparent through manual analysis.

By leveraging 0xTMAI, investors can make more informed decisions, backed by data-driven research and analysis.

Navigating the Token Metrics Dashboard

The Token Metrics dashboard is designed to be intuitive and user-friendly, providing easy access to critical information. To view the Investor Grade, navigate to the individual token details page and click on the ‘Investor’ tab on the left side of the screen.

From there, you can access the ‘Fundamentals’ tab to see how the asset is performing across nine categories, which are combined to create the overall Fundamental grade. The ‘Technology’ grade is also available, comprising data points related to Development Activity, Security and Audit, and Code Quality.

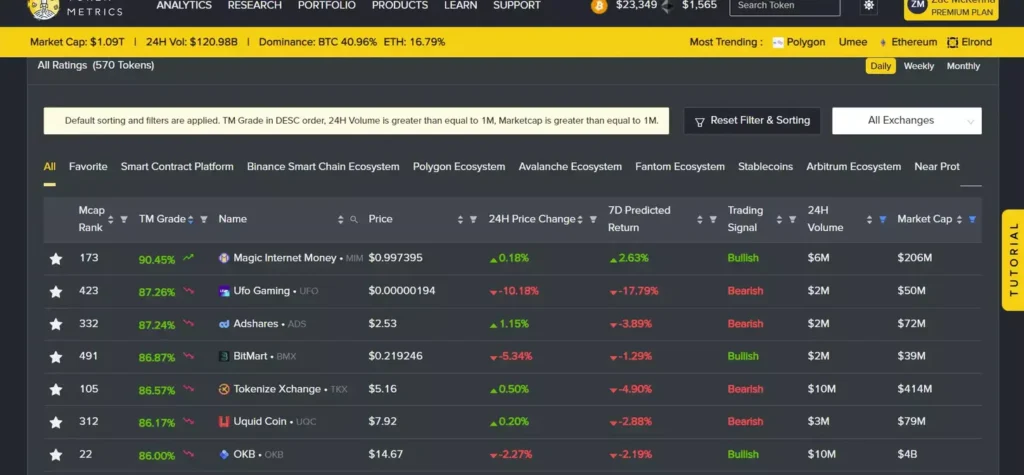

Users can sort crypto assets by our Long-term Investor Grade by toggling the Investor switch next to Trader on the Rating page.

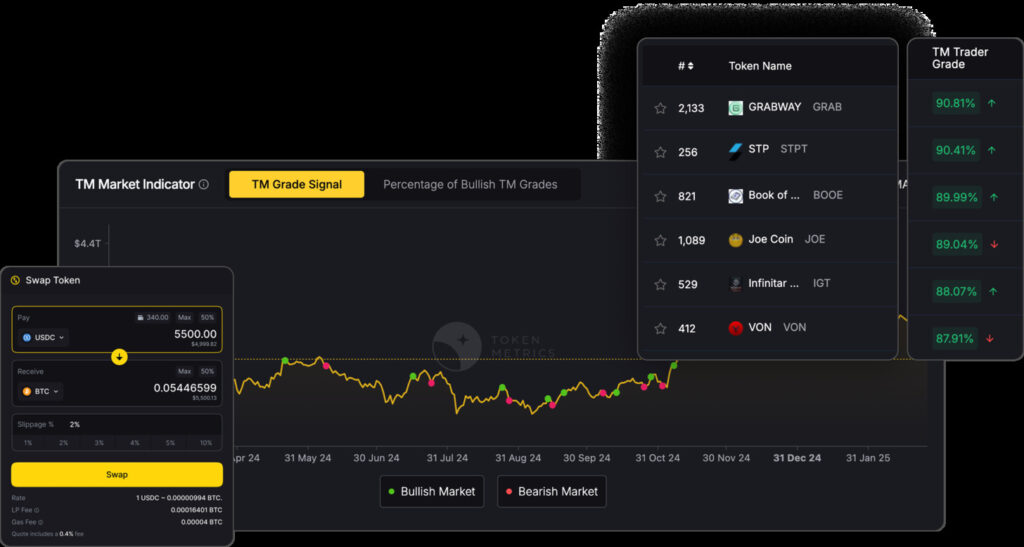

Investor Grade vs. Trader Grade: Choosing the Right Approach

When it comes to navigating the complex world of cryptocurrency, investors are often faced with a critical decision: whether to adopt a long-term investment strategy or capitalize on short-term trading opportunities. Token Metrics addresses this dilemma by offering two distinct grading systems: the Investor Grade and the Trader Grade.

The Investor Grade is designed for those who prefer a long-term investment approach, focusing on the fundamental quality and potential of a project. On the other hand, the Trader Grade is tailored for traders who seek to capitalize on short-term market movements.

Long-Term Investment Strategies with Investor Grade

The Investor Grade is ideal for investors looking to hold onto assets for an extended period. It evaluates projects based on their fundamental strength, technological prowess, and valuation. This comprehensive assessment helps investors identify projects with significant growth potential.

By focusing on the intrinsic value of a project, the Investor Grade enables investors to make informed decisions about their long-term investments. It’s particularly useful for discovering undervalued assets that could yield substantial returns over time.

Key benefits of using Investor Grade include:

- Evaluating project strength through fundamental analysis

- Assessing technological quality and security

- Comparing project worth through valuation metrics

Short-Term Trading Opportunities with Trader Grade

For those interested in short-term trading, such as swing or day trades, the Trader Grade is the more suitable tool. It focuses on price action, momentum, and technical indicators to identify potential trading opportunities.

The Trader Grade helps traders spot emerging trends and momentum shifts before they become apparent to the broader market. This enables traders to make timely decisions about entry and exit points, maximizing their potential gains.

| Feature | Investor Grade | Trader Grade |

|---|---|---|

| Focus | Long-term investment | Short-term trading |

| Evaluation Criteria | Fundamental strength, technology, valuation | Price action, momentum, technical indicators |

| Primary Use | Identifying undervalued assets with growth potential | Identifying short-term trading opportunities |

Ultimately, Token Metrics provides a comprehensive platform that caters to both long-term investors and short-term traders, offering tools that align with their respective strategies and goals.

Practical Applications of Token Metrics

The practical applications of Token Metrics are vast, empowering investors with data-driven insights. Token Metrics is not just a rating system; it’s a comprehensive toolkit for navigating the complex world of cryptocurrency investments.

Discovering Undervalued Crypto Assets

Token Metrics helps investors identify undervalued crypto assets by sorting projects based on their Investor Grade. By examining the Ratings page sorted in descending order by Investor Grade, investors can discover assets that Token Metrics believes have strong potential for future growth.

This feature is particularly useful for identifying emerging projects that may not yet be on the radar of mainstream investors. The Investor Grade provides a comprehensive evaluation, considering various factors such as token fundamentals, technology, and valuation.

Building a Balanced Crypto Portfolio

Building a balanced crypto portfolio is crucial for managing risk and maximizing returns. Metrics from Token Metrics facilitate this by providing a sector analysis that helps investors ensure they have exposure to various promising areas of the crypto ecosystem.

| Portfolio Aspect | Token Metrics Feature | Benefit |

|---|---|---|

| Sector Exposure | Sector Analysis | Diversified Portfolio |

| Risk Management | Security Assessments | Technical Risk Management |

| Position Sizing | Risk and Reward Metrics | Optimized Investment |

| Community Insight | Community Metrics | Social Strength Evaluation |

The platform’s metrics guide appropriate position sizing based on risk and potential reward, while communitymetrics offer insights into a project’s social strength and adoption potential. Furthermore, security assessments help investors manage technical risk across their portfolio holdings.

Conclusion: Leveraging Token Metrics for Informed Crypto Decisions

In the ever-evolving landscape of cryptocurrency, having access to reliable data and analysis is crucial, and Token Metrics delivers on this front. By providing a comprehensive platform that combines fundamental research, technical analysis, and valuation metrics, Token Metrics empowers investors to make informed decisions.

The platform’s data-driven approach helps cut through market noise, identifying genuine opportunities in the complex crypto market. With features like the 0xTMAI AI-powered bot and the Token Metrics Dashboard, users can stay informed and adapt to changing market conditions.

Token Metrics serves a diverse range of users, from long-term investors to active traders seeking short-term opportunities. The platform’s Investor Grade and Trader Grade systems cater to different investment strategies, providing a tailored approach to crypto investing.

As the cryptocurrency landscape continues to evolve, Token Metrics remains committed to providing regular updates and new features to address emerging trends. By fostering a community of like-minded investors focused on analytical approaches, Token Metrics is shaping the future of crypto investing.

Ultimately, Token Metrics is more than just a tool – it’s a comprehensive solution for serious crypto investors and traders. By leveraging the platform’s data-driven insights and research capabilities, users can make informed decisions and navigate the complex world of cryptocurrency with confidence.

FAQ

What is the primary function of Token Metrics?

Token Metrics is a comprehensive platform that provides data-driven analysis and insights to empower informed decision-making in cryptocurrency markets.

How does Token Metrics ensure the security of its data?

We utilize advanced security measures to protect our data and ensure the integrity of our research, providing a secure environment for our community to make informed trading decisions.

What is the TM Investor Grade System, and how does it work?

The TM Investor Grade System is a three-pillar approach that evaluates cryptocurrency projects based on fundamental, technological, and valuation aspects, providing a comprehensive grade to help investors make informed decisions.

Can Token Metrics be used for both long-term investment and short-term trading strategies?

Yes, our platform offers both Investor Grade and Trader Grade, catering to different investment approaches and providing valuable insights for both long-term investment strategies and short-term trading opportunities.

How does 0xTMAI, the AI-powered crypto analysis tool, enhance the Token Metrics experience?

0xTMAI leverages artificial intelligence to analyze vast amounts of data, providing users with actionable insights and enhancing the overall Token Metrics experience with advanced research capabilities.

Is Token Metrics suitable for both novice and experienced crypto investors?

Absolutely, our platform is designed to cater to a wide range of users, from novice investors looking to discover undervalued crypto assets to experienced traders seeking to build a balanced crypto portfolio.

How often are updates made to the Token Metrics platform and its data?

We continuously update our platform and data to reflect the latest developments in the cryptocurrency market, ensuring that our users have access to the most current and relevant information.

Can I rely on Token Metrics for building a diversified crypto portfolio?

Yes, our platform provides the necessary tools and insights to help you build a balanced crypto portfolio, leveraging our research and data to make informed investment decisions.

What kind of support does Token Metrics offer to its community?

We provide our community with access to a comprehensive dashboard, advanced research tools, and regular updates, fostering a supportive environment for crypto investors to thrive.